Break-Even Chart Slides

A Business supplies the following figures about its activities:

- Fixed Costs: €300,000

- Variable Cost: €20 per unit

- Forecast output (Sales): €20,000 units

- Selling Price: €50 per unit

Illustrate by means of a break-even chart (40 marks):

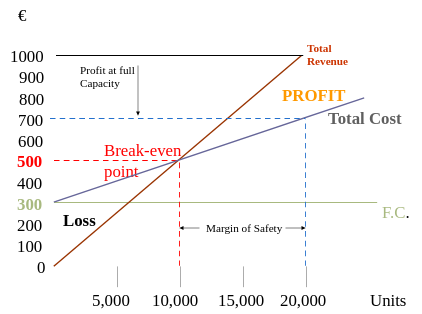

- The break-even point

- The profit at full capacity

- The margin of safety

Answer

Units 20,000

Fixed Costs: €300,000

Variable Costs (20,000 x €20) = €400,000

Totals Costs: €300,000 + €400,000 = €700,000

Total Revenue: (20,000 x €50) = €1,000,000

Profit = €1,000,000 - €700,000 = €300,000

Break-even formula:

\[\frac{Fixed Costs}{Selling Price (SP) per unit - Variable Cost (VC) per unit}\] \[= \frac{300,000}{50 -20}\]= 100,000 units

Drawing the Break-Even Chart

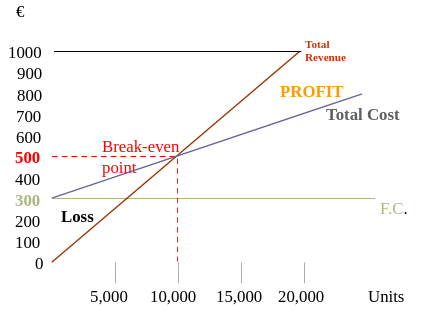

To plot break-even point on chart

From X axis 10,000

From Y axis €500,000 (10,000 x €50)

Break Even Chart

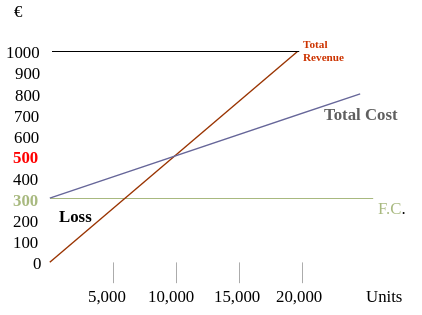

Step 1

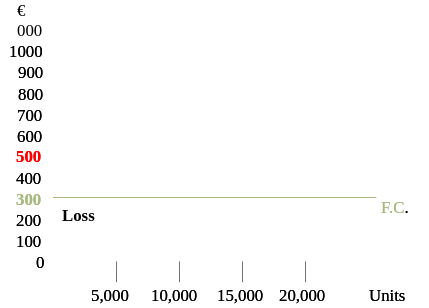

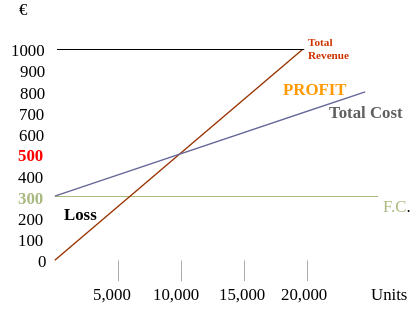

Step 2

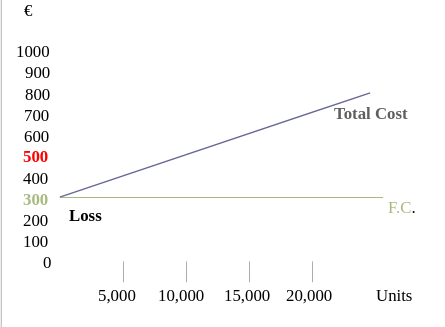

Step 3

Step 4

Step 5

Step 6

Step 7

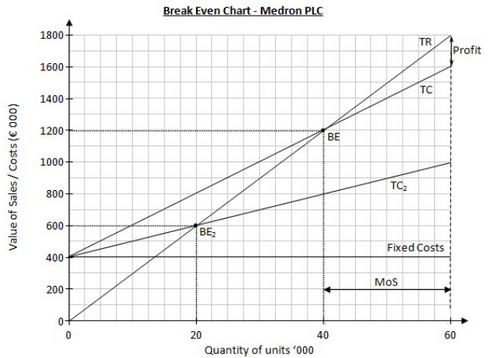

Example Question

Read the information supplied and answer the questions which follow

Medron plc has supplied the following financial information for the new medical device:

Forecast Output (Sales): 60,000 units

Selling Price per unit: €30

Fixed Costs: €400,000

Variable Costs per unit: €20

Illustrate the following by means of a break-even chart (25 marks)

- Break-even point

- Margin of safety at the forecast output

- Profit at forecast output

Answer (to Example Question)

- BEP = Fixed Costs/Contribution = 400,000/30-20 = 40,000 units

- Margin of Safety = 60,000 - 40,000 = 20,000 units

- Profit at Forecast Output = 1,800,000 - 1,600,000 = €200,000

If you only did the calculations, you would get only get 12 total marks for the question. 4 marks for the BEP calculation, 4 marks for the MOS and 4 marks for the Profit at Forecast Output

Table

| Units | Selling Price | Variable Costs | Fixed Costs | Total Costs | Total Revenue | Profit/Loss |

|---|---|---|---|---|---|---|

| 0 | 30 | 20 | 400,000 | 400,000 | 0 | (400,000) |

| 40,000 | 30 | 20 | 400,000 | 1,200,000 | 1,200,000 | 0 |

| 60,000 | 30 | 20 | 400,000 | 1,600,000 | 1,800,000 | 200,000 |