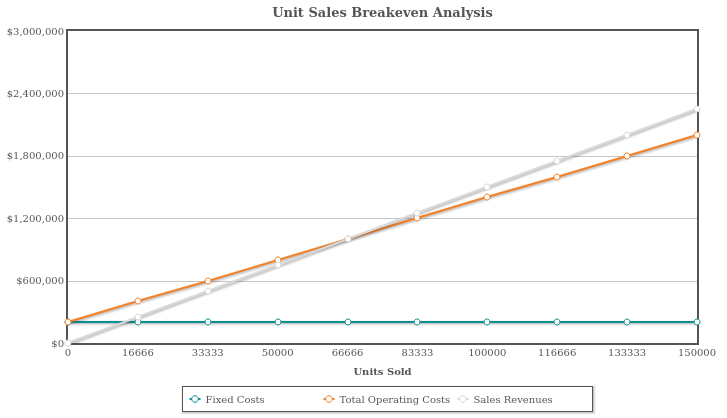

Break-Even Analysis Example

X axis = Units/Product Numbers

Y axis = Money

Forecast Output = 50,000

Fixed Costs = €160,000

Selling Price = €20

Variable Cost = €12

Selling Price - Variable Cost = Contribution

20 - 12 = 8

Contribution = €8

20 x 5,000 = 100,000

12 x 5,000 = 60,000 + 160,000 = 220,000

Break-even point (BEP) = €400,000

20,000

BEP is the point where Total Revenue and Total Cost meets

Margin of Safety

- 50,000 x €20 = €1,000,000

- 50,000 x €12 = €600,000 + €160,000 = €760,000

- €1,000,000 - €760,000 = €240,000

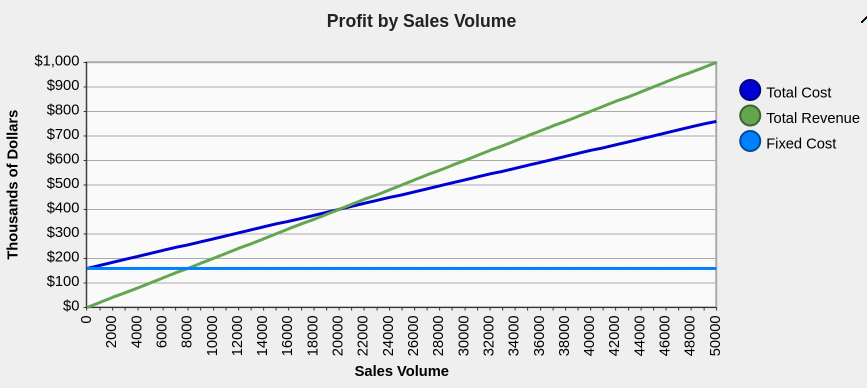

Extra Graph

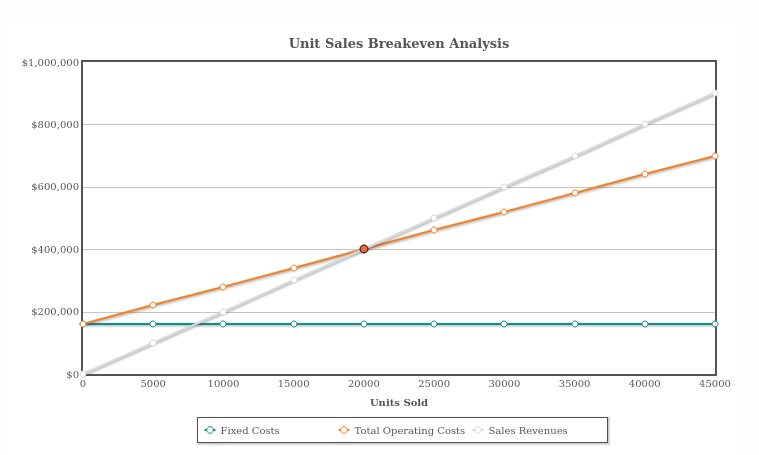

Second Break-Even Analysis Example

Forecast Output = 30,000

Fixed Costs = €160,000

Selling Price = €15

Variable Cost = €12

15 - 12 = €3

Total Costs = F.C. + V.C.

| V.C. | F.C. | T.C. |

|---|---|---|

| 12 x 5,000 = 60,000 | + 200,000 | = 260,000 |

| 12 x 10,000 = 120,000 | + 200,000 | = 320,000 |

| 12 x 15,000 = 180,000 | + 200,000 | = 380,000 |

| 12 x 20,000 = 240,000 | + 200,000 | = 440,000 |

| 12 x 25,000 = 300,000 | + 200,000 | = 500,000 |

| 12 x 30,000 = 360,000 | + 200,000 | = 560,000 |

15 x 5,000 = 75,000

15 x 10,000 = 150,000

15 x 15,000 = 225,000

15 x 20,000 = 300,000

15 x 25,000 = 375,000

15 x 30,000 = 450,000

B.E.P = N/A

Margin of Safety = N/A

Profit = €0

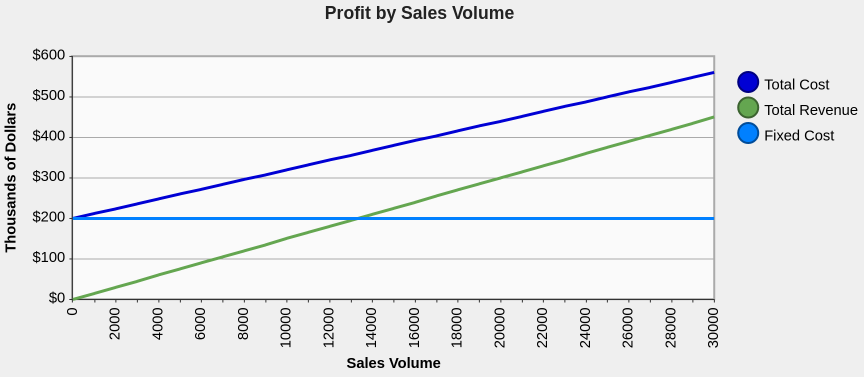

Extra Graph