15. Business Start-Up

Learning Outcomes from This Chapter

On completion, you should be able to

- Identify and explain the elements involved in a new business start-up

- List the main sources of finance available for business start-up

- Identify the elements of production processes

- Illustrate the central role of the business plan for various stakeholders

- Calculate the break-even point from forecasted sales and costs figures

- Analyse the uses and limitations of break-even analysis

Challenges when starting a new business (From Slides)

| Challenge | Explanation |

|---|---|

| Long-term finance | Attracting investment, balancing sources - not taking on too much debt (repayments), not giving away too much equity (loss of control) |

| Working capital | Having enough cash to meet day-to-day expenses (cash flow) |

| Production method | Choosing job, batch or mass (depending on USP, customer, price) |

| Ownership structure | Choosing suitable structure: sole trader, partnership or limited company |

| Marketing | Conducting research to know where to advertise, cost of sales promotions, how to use social media and public relations for publicity |

| Market research | Finding useful, up-to-date research, conduct field research (takes time and money) |

| Creating a USP | Developing features/functions to stand out from competitors and existing products |

| Location | Cost of buying/leasing shops or premises (the right place for the target market) |

| Staff | Availability/cost of staff, interviewing, employment legislation, tax |

Challenges when starting a new business (From Pages 250 & 251 of Textbook) (Click Little Triangle Above to Reveal)

A lot of the challenges outlined below are covered in more detail in different chapters of this book, but these are a summarised version of various challenges an entrepreneur will face when deciding to start their own business

Raising long-term finance

An entrepreneur needs to spend time on a good business plan to convince investors to inject capital into the business. If they choose debt capital through a long-term loan, they might find it hard to raise enough money, as they are a new business and will face regular repayments with interest as well. (You can look back to Chapter 13 to review long-term sources of finance.) If the business owner chooses to sell shares in the company to raise equity capital, they have to give away control, as shares come with voting rights. They cannot sell too many shares or they will lose control of their own company. They might also be limited by the amount of savings they haveHaving enough working capital

A new business has no credit rating or reputation for being creditworthy as it has no trading history, so it will find it difficult to buy stock on credit. If it is selling stock to established retailers, it will need to sell on credit to compete with other suppliers. Cash sales might be low to begin with as the business is unknown, so it might need to arrange a bank overdraft to allow for this. (You can look back to Chapter 13 to review short-term sources of finance.)Choosing the correct production method

The business needs to decide whether to use job, batch or mass production, which all have advantages and disadvantages. (We will look at these later in the chapter.) This decision will be made based on levels of production, automation, staffing and storage; for example, job production is used for premium products that command a high price, but it is more costly than other methods.Deciding on the ownership structure

The entrepreneur needs to decide to set up as a sole trader, partnership, co-operative or limited company. (We will look at these in more detail in Chapter 20.) Becoming sole trader is simple and allows you to trade immediately. Creating a partnership means the entrepreneur can work with a partner who has a different but complementary skillset and who might also provide capital. However, a partner will take part-ownership of the business and expect to have input on all decisionsDeveloping a good brand/product/marketing campaign

The target market will not be aware of a new company’s existence until it spends money on marketing and advertising itself. The business might need to use short-term gimmicks (sales promotions) initially, for example, two-for-one offers to boost sales or pay for Google or YouTube ads. (We will look at the marketing mix in more detail in Chapter 17.)Cost of market research

A business needs to use market research to understand where the best place to advertise is based on the characteristics of its target market. It can choose to outsource the branding and logo design and the marketing campaign to a specialist marketing business, which will cost money. (We will look at market research in more detail in Chapter 16.Creating a USP (unique selling point)

A business might have a useful idea, but it needs to stand out from competitors. A USP that sets the product apart from what competitors offer without infringing on copyright or patenting issues is essentialAvailability of location

A great business idea might not work in the wrong location. The cost of rent can be prohibitive for a new business, especially one looking for a premium location with better footfall, i.e. passing trade. Choosing a cheaper location might result in lower sales, as fewer people walk by the shop. Then there is the cost of fitting out the premises to the owner’s liking, including furniture and fittings, purchasing machinery and potentially hiring an interior designerAvailability of suitable staff

When the country is close to full employment and everyone who wants a job has one, it is hard for a business to find staff, let alone excellent staff. The business might have to offer higher wages and better working conditions to attract staff from other jobs, and staff might not want to work for a new business if they are unsure of job security.Debt vs Equity

| Term | Definition |

|---|---|

| Debt | Money we owe |

| Equity | What we own e.g Profits |

Types of Production

(From Teacher)

| Term | Definition |

|---|---|

| Job Production | 1 off, unique protection of a ‘product’ usually called bespoke e.g art, wedding dress, unique/custom jewellery |

| Batch Production | Usually produce products in multiples e.g 10’s. 100’s, 1000’s. Produced by colour or size |

| Mass Production | All products are made on an assembly line. Continuous production |

Production Options

(From Slides)

| Type | Explanation | Features of Process |

|---|---|---|

| Job | Specific product made to meet a consumer’s needs, e.g. a wedding dress | Specialised/expensive labour, flexible machinery, premium price, slow process |

| Batch | Production of a limited quantity of identical products, e.g. a batch of Maths books | One batch at a time (same size, shape, colour), semi-skilled labour, made for stock |

| Mass (flow) | Continuous production of the same item, e.g. toilet paper, biros | Items used up regularly, lower labour needs, highly automated, made for stock |

Features of Types of Production

Job Production

- Products are unique, so they vary from customer to customer

- Labour intensive, requiring skilled or specialised staff, increasing wage costs

- Requires flexible machinery that can be adapted for each design

- Might be hard to buy raw materials in bulk, as different orders require different raw materials (increases cost per unit)

- Sold at a premium price, as products are of a higher standard

- It is a slower process, so fewer orders can be made compared with batch or mass production

Batch Production

- Employees are usually semi-skilled but generally less skilled than for job production, which lowers production costs per unit

- Quicker production process than job production, as goods can be made for stock, not just when an order is made by a customer

- Machines can perform various jobs and sizes to suit different batches

Mass Production

- A high degree of automation is involved, so a large capital investments required

- Labour needs are lower and tend to be less skilled, for example, factory line workers with few tasks; this can lead to worker boredom

- Materials can be purchased in bulk, so goods can be made for a much lower cost per unit

Impacts of Changing from Job to Mass or Batch

- Investment required

- Loss of USP

- Effective stock control

- Reduced prices

- Lower profit margin

Impact of Moving from Batch/Mass to Job

- Fewer options for customers

- USP can be developed

- Capital investment required

- Impacts staff

- Training required

- Less diversified business

- Brand image impacted

Business Plan

| Term | Definition |

|---|---|

| Business Details | Outlines the objective for the business (mission statement), vision, location and ownership type (e.g. partnership or limited company) |

| Market Analysis | Research on the size of the market, different segments and characteristics of the chosen target market |

| Marketing Plan | 4 Ps for a good/service: <ul><li>Product: USP, branding</li><li>Place: channel of distribution</li><li>Price: strategy (e.g. premium, penetration) </li><li>Promotion: advertising, sales promotion</li></ul> |

| Production Plan | Time/labour/materials/machinery required for production (per unit) Production process: job/batch/mass |

| Financial Plan | Cash flow forecast, long-term finance (debt/equity), break-even analysis |

Business Plan (From Page 257 of Textbook) (Click Little Triangle Above to Reveal)

A business plan is a written document prepared by the entrepreneur to lay out what the business is and what it wants to achieve. It also explains the strategies for marketing, ownership, production and finance, and identifies areas of opportunity.

Elements of a business plan

| Business details and ownership | This describes what the business is, where it is located, who owns it and what skills, experience and qualifications they have. It outlines what market the business will operate in and set out its long-term vision in the mission statement and strategic plan |

| Market Analysis | It includes data the business has collected about the market in which it plans to operate. It will need to show the potential size of the market, and how the market is broken up (for example, segmented by age, gender, location), and see if it is dealing in a niche market. Information on competitors, trends and recent sales figures also go in this section along with targets for the business |

| Marketing Plan | A marketing plan is based on the 4Ps:

Product: the USP, branding, the shape, design, function Price: the pricing strategy (for example, premium, penetration, price discrimination, tiered pricing) the business plans to use and how that compares with competitors Place: where it will be available for sale, whether through wholesalers/retailers/online and why those points of sale suit the target market Promotion: information on the planned advertising campaign, its potential reach, cost, options, what sales promotions it might use to increase sales when launching (for example, two-for-one introductory offers) |

| Production Plan | This outlines where the factory or warehouse is and the cost of purchasing or leasing it. It also contains the number of machines and computers needed, staffing costs and recruitment plans. It includes the type of production used (job, batch, mass), and why. It states whether the business will strive for any quality symbols (ISO 9001, etc.). It details where it will source raw materials, what they will cost, different options, where they will be stored, etc. |

| Financial Plan | This gives financial projections for the short term using a cash flow forecast. It might include sources of finance such as negotiated overdrafts or trading terms from suppliers.

It shows long-term financial projections (predicted future sales and profit levels) as well as sources of finance available, i.e. the amount of long-term loans (debt capital) and shareholders’ investment (equity capital). It can also list any assets used as collateral against loans taken out. A break-even analysis can be included to show how many units need to be sold so that the business will not make a loss |

Importance of a Business Plan for an Entrepreneur

| Term | Definition |

|---|---|

| Focus on the future | Prepare for the future, provide a map/guide |

| Anticipate problems | Proactive contingency plan for foreseeable problems |

| Attract investors | Use business plan as sales pitch, highlight the potential of the business |

| Act as a means on control | Compare plan to actual performance, take corrective action |

Importance of a Business Plan for an Entrepreneur (From Page 258 of Textbook) (Click Little Triangle Above to Reveal)

Focuses on the Future

A plan makes an entrepreneur sit down and prepare for the future rather than living day by day and hoping things will work out. It helps them to set goals that have time limits and put strategies in place to achieve these goals; it is like a map or guide for the entrepreneur to follow. A break-even chart helps to calculate how many goods need to be sold for the business to achieve profitability within a certain timeframe.Anticipates Problems

An entrepreneur has to plan ahead, they have to be proactive rather than reacting to situations. A plan should contain contingency for any delays or issues that they foresee as a possibility A cash flow might show that the business will run out of cash temporarily at a certain time so the entrepreneur can adjust spending or arrange an overdraft to cover thisAttracts Investors

The entrepreneur can use their business plan as a sales pitch, as it should highlight the potential of the business. It shows the strengths of the business and analysis of the market it is entering to indicate if it has profit potential. Investors will supply finance based on the sales pitch. A bank will also look at the business plan to assess the entrepreneur’s ability to repay a loan A business plan can show investors the level of planning in place and also reveal how much the entrepreneur has invested, which can be an indicator of how much they believe in the ideaActs as a Means of Control

An entrepreneur can compare actual performance against the plans they set out in their business plan. They can use this to see if they are on course to achieve their stated objectives and, if they are not, take corrective action If sales are below where the business plan aimed for after year one, the entrepreneur could consider increasing their advertising budget in the plan to promote salesUses of the Business Plan for Various Stakeholders

| Term | Definition |

|---|---|

| Employees | Understand business netter and assess job security |

| Shareholders | Projected sales/profits help calculate return on investment (ROI) vs risk |

| Financial Institutions | Sales projections; cash flow forecast shows ability to repay loans |

| Management/Employers | Compare plan against actual, take corrective action, request a bonus |

| Suppliers | Assess credit worthiness of the business before deciding to sell on credit |

| State Agencies | Local Enterprise Offices (LEOs) and Enterprise Ireland assess businesses before offering grants/subsidies |

Break-Even Analysis

| Name | Definition | Formula/Example | |————————-|—————————————————————————————|————————————————| | Fixed Costs | Costs that remain the same irrespective of the level of output | Rent, loan repayments | | Variable Costs | Costs that change as the level of output changes | Direct wages | | Contribution per Unit | How much each unit sold will make after deducting the cost of manufacturing | Selling price - variable cost per unit | | Break-Even Amount | The number of units a business needs to sell to cover total costs | Fixed costs ÷ contribution per unit | | Profit at Full Capacity | How much profit the business plans to make if it successfully sells the target output | Total revenue - total costs | | Total Revenue | The sum raised from selling goods | Selling price x output | | Total Costs | The sum of all the costs of production | Fixed costs + variable costs | | Margin of Safety | How far forecasted sales can fall before the business becomes lossmaking | Forecast output - break-even amount (in units) |

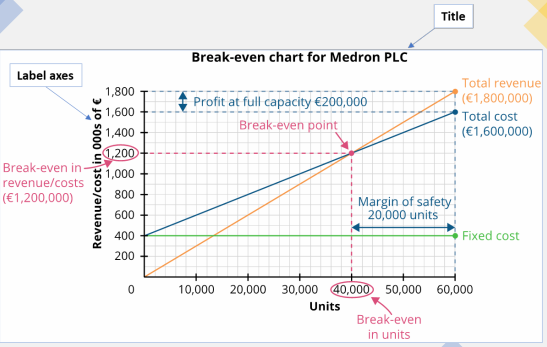

Steps in drawing a break-even chart

- Draw and label the axes

- Add lines for total revenue, total cost, fixed cost

- Show the break-even point, break-even revenue/cost and break-even units

- Highlight the margin of safety and profit at full capacity

Benefits and limitations of break-even analysis

Benefits:

- Shows forecasted profits at different sales levels

- Shows the size of the safety net if sales don’t meet targets (margin of safety)

Limitations:

- Prices may have to be lowered to sell more units, as it will help increase the demand, and the break-even analysis shows the projections based on the selling price remaining consistent

- Variable costs might decrease when buying in bulk so won’t be constant over all quantities. A break-even analysis is based on variable costs remaining the same at all levels of output

- Does not factor in any sales that are returned by consumers (e.g. faulty goods)