11. Insurance and Taxation

Learning Outcomes from this chapter

On completion, you should be able to:

- Illustrate the differences between various principles of insurance

- Identify the various insurance forms

- Define ‘risk management’ and illustrate ways a business can effectively manage risk

- Outline the types of insurance a business and a household might use

- Outline the types of taxation a business and a household might have to pay

- Illustrate the implications of different taxes for a business and a household

- Calculate take-home pay for an employee

- Explain the importance of insurance and tax for a business

- Identify activities common to managing a business and a household

- Understand the similarities and differences between these activities in a business context and in a household context

Principles of insurance

| |

|

| Utmost good faith |

Must disclose all material facts when applying for insurance |

| Insurable interest |

The insured must gain from an item’s existence or suffer financially from its loss |

| Indemnity |

A person cannot profit from insurance |

| Subrogation |

Rights to recover losses transfer to insurance company after the insured is fully compensated by them |

| Contribution |

If more than one insurance company is required, any pay-out is proportionally divided |

Average Clause

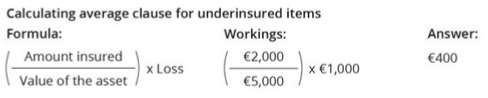

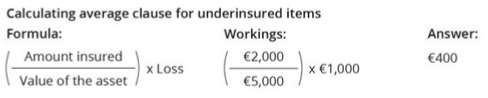

The average clause applies if an item is underinsured and there is a partial loss, meaning the loss was less than the full value of the item insured. If a bicycle was insured for €2,000 but its real value was €5,000, and damage of €1,000 was caused to it the insured party should not receive €1,000 in compensation, as they do not have the whole bike insured. In this instance they have 2/5 of the bike insured, so should receive 2/5 of any partial loss: 2/5 x €1,000 = €400

Factors that affect the size of your insurance premium

| Level of risk faced |

The higher the probability of the insurance company having to pay a claim, the higher the premium. A loading is added to a premium for a higher risk (e.g. driver’s penalty points). A deduction makes a premium cheaper (e.g. no claims bonus). |

| Value of the item |

The higher the value of the item and the potential pay-out, the higher the premium. |

| Number of claims made |

If the insurance company sees an increase in the number of pay-outs for a particular type of claim, the costs of premiums will rise to offset this. |

| Profit level required by insurance company |

Many insurance companies are public limited companies, so their main objective is to achieve a certain level of profit to satisfy their shareholders. |

| Government levies |

If a levy (an extra charge) is applied to an insurance type, it will be applied to relevant premiums, increasing the price. |

Risk Management

- A planned approach to handling the risks facing a business, by identifying all the possible risks it faces, then taking measures to reduce some risks.

- Effective methods:

- Take out insurance for the risk.

- Introduce or improve safety procedures.

- Carry out safety audits (internal/external).

- Upskill/train staff in safety.

- Install CCTV, fire doors and an alarm system.

Business risks and types of insurance to protect against those risks

| Risk to the business |

Type of cover |

Explanation of cover provided |

| Structural damage to the factory, warehouse or office building |

Buildings insurance |

Protects the business against loss or damage to the structure of the building caused by fire, flood or storm |

| Damage to stock, raw materials, components, etc. |

Contents insurance |

Protects the business against loss or damage to contents caused by burglary, fire or flood |

| Being involved in a road traffic accident |

Motor insurance |

Third party insurance is the minimum cover required by law. It protects everyone injured in the accident except the policy holder. Comprehensive insurance protects everyone injured in an accident, including the policy holder |

| Losing an important member of staff |

Key person insurance |

Protects the business against the loss of a valuable staff member |

| A customer injuring themselves while on the business premises |

Public liability insurance |

Protects the business against claims by members of the public for injury or loss resulting either from an accident on the business premises or the actions (or inactions through negligence) of the business |

| A worker injuring themselves while carrying out their job |

Employer liability |

Protects the business against claims made by employees as a result of accidents in the workplace |

| Having cash or stock stolen by an employee |

Fidelity guarantee insurance |

Protects the business against dishonesty or fraud committed by an employee |

| Company’s products harming a member of the public |

Product liability |

Protects the business in the event of a defective product that might have caused harm to the customer |

| Loss or damage to goods in transit or storage |

Goods in transit insurance |

Protects the business for loss suffered from theft or loss of goods while in transit, damage caused during transit, or the consequence of any delay in transit |

| Shop windows being smashed |

Plate glass insurance |

Protects the business against damage to or breakage of large panes of glass (e.g. shop windows) |

Household risks and insurance types

- Personal illness or injury (health insurance)

- Risk of death (life assurance)

- Damage or theft to home possessions (house and contents insurance)

- Road traffic accident (motor insurance)

- Not being able to meet mortgage repayments (mortgage protection)

- Damage or loss of device (gadget insurance)

Types of taxes a business pays

- Value added tax (a tax on consumer spending)

- Corporation tax (a tax on a company’s profits)

- Self-assessment tax (a tax on income earned in the previous year)

- Custom duties (a tax paid on importing goods from outside the EU)

- Commercial rates (charges to local authorities, e.g. county councils)

- Employer’s PRSI (employer contribution to PRSI per employee)

Types of taxes a household pays

- PAYE – Pay As You Earn (tax on income earned from employment)

- Local property tax (a tax on the market value of a house)

- Self-assessment tax (a tax on income earned if self-employed)

- PRSI – Pay Related Social Insurance (social insurance that acts like a tax)

- DIRT – Deposit Interest Retention Tax (a tax on interest earned in deposit accounts)

- CGT – Capital Gains Tax (a tax on the profit from the sale of an asset)

- CAT – Capital Acquisitions Tax (a tax on inheritance and gifts)

- USC – Universal Social Charge (a tax on total income)

- Motor tax (a tax paid by vehicle owners)

Taxation Terms

| |

|

| Tax rate |

Percentage charged for a certain tax (20%–40% for PAYE) |

| Tax credit |

Tax allowance, reduces tax payable (PAYE credit) |

| Tax band |

A bracket of earnings within which a certain rate is applied |

| Tax evasion |

Illegally reducing how much tax you pay (under-declaring income) |

| Tax avoidance |

Legally reducing how much tax you pay (tax loopholes) |

Steps to calculate take-home pay

- Calculate taxable income

- Calculate PAYE

- Calculate USC

- Calculate PRSI

- Calculate take-home pay